A life insurance policy is a contract between the policyholder and also the Insurance organization. A lump quantity of cash is paid out into the beneficiaries following the insurer’s departure in yield for the premium payments. The coverage can pay the premium at once or as instalments. The insure person’s health status has to be clearly written in the contract in order for it to be enforceable. It is an easy method to ensure that your loved ones will soon be safe even when something happens to you. Parents using little or otherwise abled children, elderly men and women, grown ups that have property with each other are some of those who should execute a Life Insurance Comparison and get yourself a policy.

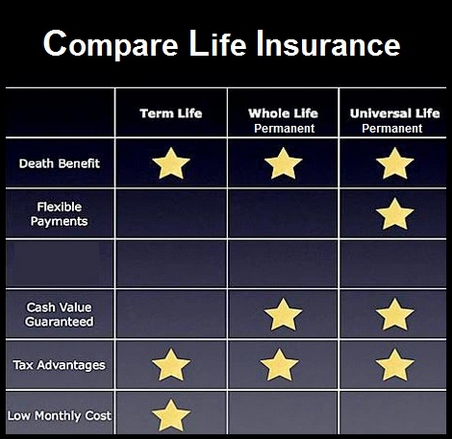

Types of life insurance programs

• Term life: These plans Endure for a predetermined amount of decades, most generally 10, 20, or even 30 years

• Amount term: The premium to be paid is the exact same every year.

• Increasing term: The higher rate of these premium increases as the policyholder grows older.

• Lasting: These coverages are more costly than term procedures however they continue for the policyholder’s full lifetime till they quit having to pay the high quality.

• Single top: Rather than paying the high quality from instalments, the policyholder can pay it up.

• Closing or burial expenditure: This really is sort of permanent policy that includes a little health profit.

How You Can Compare Life Insurance Policies

What are several issues one ought to check while a Life Insurance Comparison? Deciding on a supplier can be exceptionally Essential. The standing and the monetary balance of the company picked are of top worth. Start looking for how a coverage will benefit you personally in certain conditions. Hence, flexibility is very crucial. Do a little research in regards to the customer support of the business. A very good provider offers high-quality customer service and is always ready to answer some questions the policy-holders could have. Talk for the company about your lifestyle and settle on which approach may be your best one for you.